Why is Gallatin Giving "Woolhawk" a Tax Break When They are Considering Raising Our Property Taxes?

- Pascal

- May 11, 2020

- 5 min read

The tax deal for the Facebook (shhh...) Data Center comes before the Gallatin City Council Work Session on Tuesday at 6PM. I've read through it a few times, and it is not clear how much of a tax break they will get. The agreement states that "it is sometimes necessary to entice such commercial enterprises with financial incentives; and […] the Industrial Development Board has proposed a PILOT program incentive with Woolhawk, LLC, a Delaware limited liability company". If you want to read the entire agreement, it is on the Gallatin Website under Tuesday's City Council Agenda.

At a quick glance, it looks like Gallatin made a good deal, something for the goodwill of the citizens, that will bring in significant revenue. It states that the company will pay $1Million per year for the first building, and gives a decreasing scale for each building after that. But it is hard to know for sure until we see all the numbers. We won't know until the deal is done because that is how these things go. We as citizens want transparency, because this is our city, we live here, and it affects our way of life and our tax dollars. The companies on the other hand, want confidentiality during the negotiation process.

As usual, I have a lot of questions. Financial incentives are being given to entice - how much of a break are they being given? What is a PILOT program incentive? What does the Industrial Development Board have to do with it?

I did some research, and here is a quick explanation of how PILOTs work:

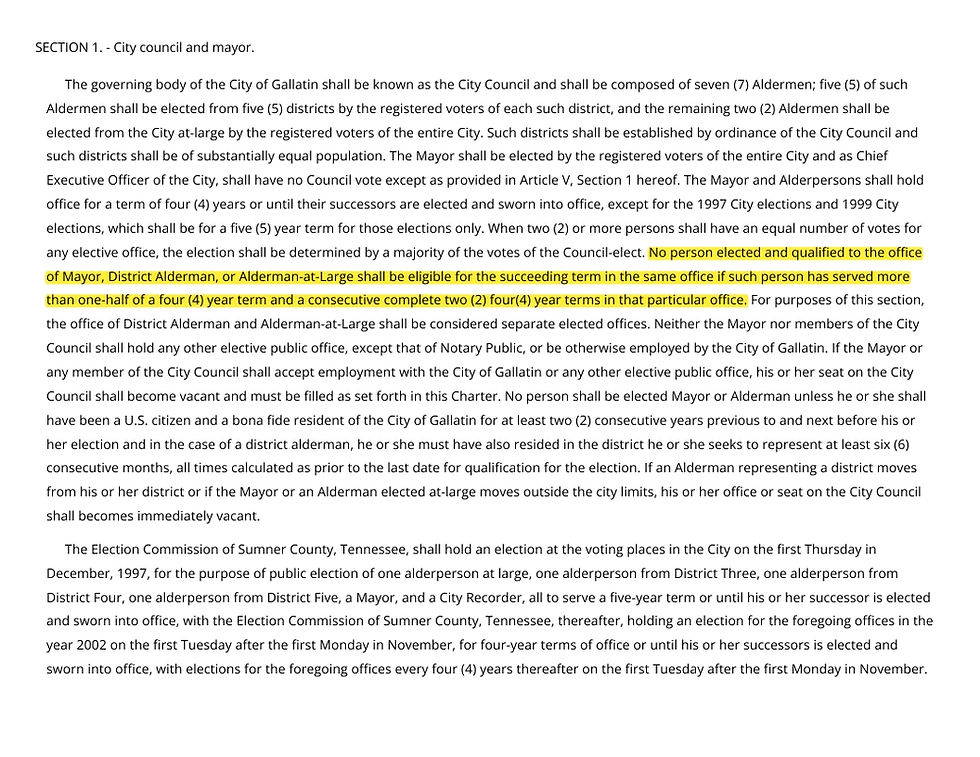

Local governments use different incentives to encourage businesses to invest in their communities, and one of these incentives is the abatement of local property taxes. A very common incentive used in many states. Tennessee's constitution prohibits the abatement of property tax for businesses. Tennessee law requires property tax to be paid on all property unless it is owned by a tax-exempt entity (like a church or a government entity). So, the way the government has figured out a work-around is this: Tennessee's local governments can abate a business's property taxes by leasing tax-exempt properties to them. Industrial Development Boards (IDB) are allowed to own property, and local governments can authorize IDBs to negotiate and accept PILOT (Payment in Lieu of Tax) agreements that are equal to or less than the property tax that would have been owed on the property. PILOT agreements are structured as sale-leasebacks. Typically, the company sells the land to the IDB (a tax-exempt, government entity) and the IDB leases the land back to the company. Some interesting data from TN.Gov/TACIR, states that the payments made in lieu of tax to IDBs in the state of Tennessee are equal to approximately 47% of the amount that would be owed for the assessed property tax if the land was owned by the company.

Governor Bill Lee recently (April 30, 2019), signed into law changes to simplify taxation of leasehold agreements, reducing the ongoing red tape involved in PILOT agreements. Will this mean PILOT incentives will become more prevalent for big and small companies? We keep hearing that Data Centers bring more Data Centers (Woolhawk is the second one for Gallatin, Archer Data Center is currently under construction). Will Gallatin become the "City of Computer Warehouses" because we have so much affordable farmland?

There is no law specifying how PILOT revenue must be distributed. The IDB can keep it for economic development, or it can be distributed to local governments to use as they wish. This brings up the question of how this money will be used. Sumner County pays for our schools. Will Gallatin's IDB give sufficient money from this deal to Sumner County? Especially since Sumner County voted in 2018 to break a Trust, relinquishing their rights to the large 369 acre parcel which is now part of this development, and had initially been dedicated in the Trust for agricultural purposes. Does the IDB have an agreement to give sufficient funds to both the City of Gallatin and the County? If it were simply tax dollars, the funds would be distributed a certain way, but since it is not, how will these funds be used?

Tennessee law limits PILOT agreements for up to 20 years plus up to three years for construction. The PILOT agreement can be for longer than 20 years only if approved by the TN Comptroller of the Treasury and the TN Commissioner of Economic Community Development. This specific agreement with Woolhawk is for 20 years, plus construction time. At the end of this 23 years, then the company's tax abatement will run out, and they will begin paying the amount that would be equal to the tax amount. How much is this? According to several research papers, Facebook Data Centers get a lot of perks, with an average tax abatement of 40%. For example, Henrico County in Virginia where one of their 970,000 square foot data centers is located, introduced tax breaks on computers and other data center gear , cutting the tax rate by 87 percent, from $3.50 per $100 of assessed value to 40 cents. For their nearly 1 million-square-foot facility in Altoona, Iowa, city officials agreed to waive property taxes for 20 years. In exchange, Facebook will pay the city $3 per square foot — or about $3 million per year for 20 years, a discount of about 40% compared to paying property taxes over that time span.

Are Facebook and Google starting to lobby all of our governments to get laws changed so that this big tax increase won't kick in 20+ years from now? Can you imagine all of these data centers that are being built and have significant tax abatements all coming due for a giant tax increase at the same time 20 years from now? Who is going to feed that monster? One thing that I find interesting in this agreement is that the PILOT amount paid for each building is a flat rate. $1Million per year for the first building and equipment, (incrementally decreasing down to $550,000.00 for the 6th building) defined as a data center containing at least 155,000 square feet. So they have an incentive to make the buildings as gigantic as possible? The bigger the building, the bigger that tax break. Improved property value is taxed based on square feet, and they are getting a flat-rate deal?

How much revenue will Gallatin really get? That depends on if Woolhawk is selling the land to the Gallatin IDB? Or giving it for free to the IDB? If they are selling, how much is Gallatin paying for the land? We know how much the payment to the IDB is, it is a flat rate based on how many buildings are built. That is all we know. How much is distributed to the City and the County, and what will that money be used for - who knows?

Facebook is not coming to Gallatin because we are the Nicest Place in America. They come here because we have cheap land and our City is giving them a substantial tax break.

Our Mayor keeps mentioning our property tax rate could be adjusted this month, meaning a possible tax increase. At the end of the day, the real question is why do these giant corporations get a tax break and our taxes continue to go up?

I encourage you to tune in to the Gallatin City Council Meeting this Tuesday at 6PM, and the Industrial Development Board meeting on Wednesday at 4:30PM and listen to the questions our elected officials are asking. For information on how to join the meeting electronically, go to the city website, GallatinTN.GOV

Comments